Background

With increasing pressure on national oil companies (NOCs) to fund oil and gas (E&P) operations, due to national budgetary constraints, NOCs have resorted to undertake ‘Alternative Funding’ arrangements in order to sustain the operations and achieve reservoir addition and production volume objects.

Without such arrangements both of these goals and consequently national petroleum revenue objectives are likely to remain unrealisable.

However, the various options for the marketing of NOCs Equity Crude are sometimes limited by the net available crude volumes after the ‘carrying company’ (usually the operator International Oil Company (IOC) may have deducted its’ Entitlement Crude’ volumes for Cost Recovery purposes.

This 10 day program has been designed with a view to present current global trends in Crude Oil Marketing by IOCs, NOCs, Global Oil Traders, Oil Futures Traders & the way different NOCs market their crude.

Similarly, the program highlights the best approaches to Crude Oil Marketing and the various advantages & disadvantages inherent in them.

Participants will in addition gain significant insight into how to minimize unending (prolonged) Cost Recovery using Entitlement Crude allocated to IOCs who are in JV with NOCs and who usually provide ‘Carried Interest Finance’ under most alternative funding arrangements

This course is highly recommended to those engaged in

- Crude Oil Marketing

- Crude Oil Shipping & Terminal Operations

- Cash Call Administration for Joint Venture (E&P) Operations.

Course Content

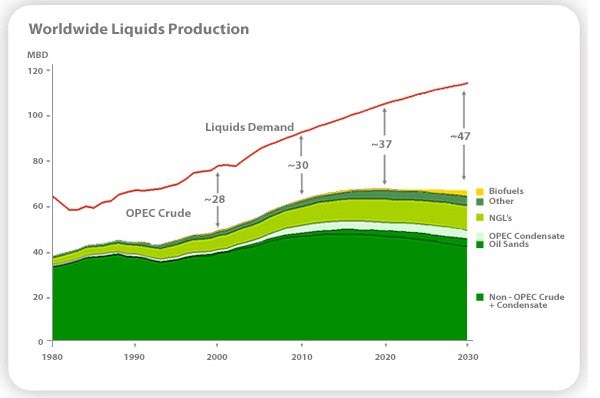

- Overview of World Oil Markets, Crude Oil Supply & Demand Pattern, OPEC & Non-OPEC Supply, Strategies Issues & Projections for the Future of Global Oil Supply & Demand.

- Crude Oil Physical Characteristics, Classifications & Specifications.

- Crude Oil Pricing:

- Underlying Pricing Mechanism

- Fixed & Floating Prices

- Crude Oil Markets

- The Regional Markets

- Forward Paper Contracts

- Long term Oil markets: Participants, Market Liquidity, Contractual Issues,

- Using Long term Derivative

- Hedging

- Purpose of Hedging

- Hedging Instruments

- Hedging Strategies

- Pure Futures & Options

- The Futures Market:

- Speculation and Arbitrage

- Contango & Backwardation

- Using Futures to Hedge Prices

- Crude Oil Purchase and Sales Contract Negotiation & Documentation.

- Oil & Gas Exploration & Production Contract Types:

- Joint Venture (including Typical Flow of Fiscal Components in Concessionary (JV) System)

- Product Sharing Contract (PSC)

- a. The PSC/PSA and Fiscal System Contractual Stability

- b. PSC Fiscal System’s Flow

- c. Types of PSCs in Various Producing Countries

- d. Other Factors Used in Profit Oil Share

- Service Contract

- Other Provisions of Oil & Gas (E&P) Transactions & Contracts (E.g. JOA, PPTA, MOU & PSA)

- Royalty, Petroleum Profit Tax, Petroleum Revenue Tax

- Tax Holidays

- Investment TAX Allowances

- Tax Inversion (Incentive & Penalty Calculations)

- Taxation under JV vs. PSC and Service Contract Taxation

- Reserves Booking under JV vs. PSC and its implications

- The Principle of PSC Cost Recovery Ceiling

- PSC Cost Recovery Mechanism & Modelling (including Capital Allowance, Allowable Intangible Costs, Investment Tax Allowance and the recovery of Gas Cost from Oil Operations)