Course Description:

This course is designed to improve the hands-on know-how of participants whose functions have to do with crude oil shipping in whatever form. It has been designed for practical purposes; particularly to draw knowledge from more experienced people in the global industry. The combination of crude oil marketing and shipping operations in a single course underpins the relevance of comprehensive understanding of the critical phases in the logistics of selling and safe delivery of crude oil parcels globally. The inclusion of a visit to Lloyds’ office and possibly to the London Exchange where crude oil is traded daily also brings to bear the practical nature of the program.

Course Contents:

1. Overview of World Oil Markets

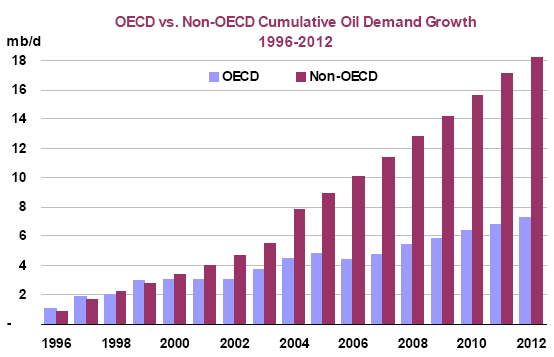

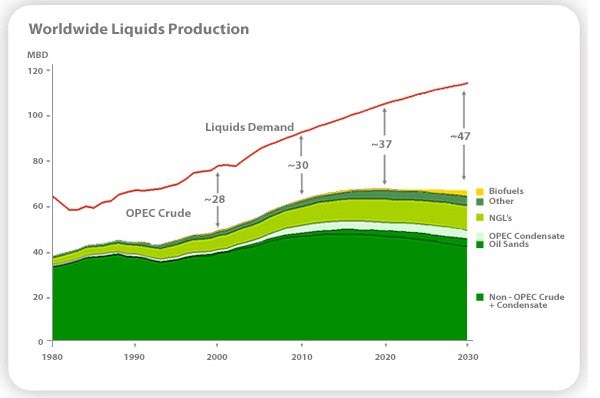

- Crude Oil Supply and Demand

- OPEC and Non-OPEC Supply & Strategies

- Issues & Projections for the Future

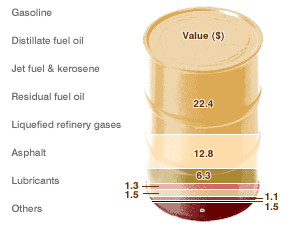

2. Crude Oil Physical Characteristics, Classifications & Specifications.

3. Pricing

- Underlying Pricing Mechanism

- Fixed & Floating Prices

- Contango & Backwardation

4. Crude Oil Markets

- The Regional Markets

- Forward Paper Contracts

- Long Term Oil Markets: Participants, Market Liquidity, Contractual Issues,

- Using Long term Derivatives

4. Hedging

- Purpose of Hedging

- Hedging Instruments

- Hedging Strategies

- Pure Futures & Options

6. The Futures Market: Speculation and Arbitrage

7. Crude Oil Purchase and Sales Contract Negotiation & Documentation

Who Should Attend?

- Crude Oil Shipping Coordinators / Supervisors

- Crude Oil /Gas Marketers, Corporate Planners

- Finance & Accounts Staff, Officer in charge of Revenue Accounting

- Commercial Officers, Business Development Staff, Security Managers